Attacks & More Tax !

In March the Chancellor announced tax changes for property investors. In this article we consider the effect of one of these changes ….. Reduced Tax Relief.

From 2017 the amount of tax relief that some landlords can claim on their finance costs (such as mortgage interest payments) is gradually being reduced. When the changes take full effect in the 2020/21 tax year, landlords will only be able to claim tax relief at the basic rate of 20%, instead of 40% or 45% for those in higher or top rate tax brackets, respectively.

The Current Rules

Currently as a landlord you can claim all of the interest-only part of your buy-to-let mortgage against the rental income generated from your property. So, if you’re in the 40% income tax bracket, your tax bill will be 40% of the difference between these two elements.

For example, let’s say your Crawley investment property generates £12000 pa in gross rental income. If you have a buy-to-let mortgage & pay interest of £9000 pa, your net profit will be £3000pa.

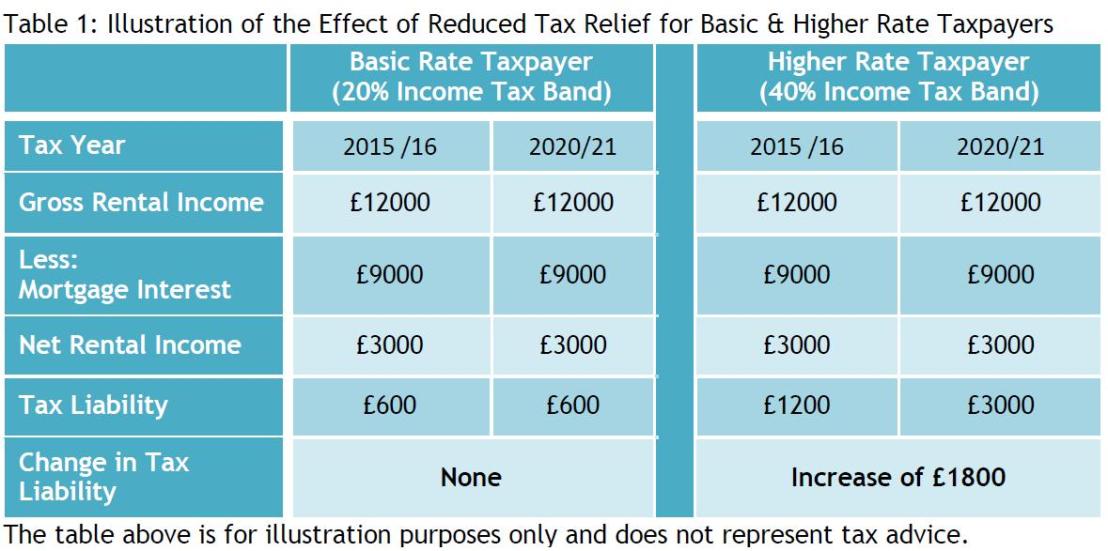

If you pay income tax at the basic rate of 20%, then you would owe the Revenue £600 i.e. 20% of £3000. If you’re in the 40% higher tax band, however, you would have to pay £1200 in tax i.e. 40% of your £3000 profit. Our example is summarised in Table 1.

New Tax Regime from 2017

By 2020/21, when the transition period for changes to tax relief are completed, you will only be able to deduct 20% of the mortgage interest from your tax liability. To illustrate the impact, let’s re-visit the previous example. Again, this is summarised in Table 1.

If you’re a basic rate tax payer, in 2020/21 your tax liability will still be £600 i.e. 20% of your £12000 rental income LESS 20% tax relief on your mortgage interest. So nothing changes.

Unfortunately, if you’re a higher rate tax payer you won’t be so lucky. As a taxpayer in the 40% income tax bracket, from 2020/21 onwards your rental income will be taxed at the rate of 40%, BUT your mortgage interest relief can only be deducted at the rate of 20%.

With reference to our previous example, if your rental income is £12000 pa, you’ll have to pay tax on this amount at the rate of 40% i.e. £4800. Although you will be able to deduct mortgage interest, in 2020/21 this can only be done at the basic rate of 20%. In our example this amounts to £1800. Hence your tax bill for the property in 2020/21 would be £3000. So you would be £1800 worse off compared with now.

Please note the above is not & should not be considered as tax advice. In order to obtain expert tax advice your should consult with a qualified accountant or tax advisor. They may be able to suggest ways in which you can reduce your tax liability.

The opinions expressed in this article are those of the author only and not of Northwood. If you are considering investing in property, please make sure that you seek appropriate professional advice.