Crawley v’s Redhill: Investment Property – Not Football !

One of our landlords called up the other day looking to invest in another flat. Flats are his thing rather than houses and he already has investment properties in both Redhill & Crawley. He’d seen a few flats for sale in both towns and was asking our advice as to which location we thought would be better.

This got us thinking about both capital growth & rental yields in both towns. So we decided to take a closer look by comparing roughly similar types of properties in both locations, to see which one was the “best”.

Crawley people will be familiar with the Maidenbower flats at Fenchurch Road, Lyon Close and Dakin Close, while those from Redhill will be familiar with the “St Anne’s” development. Both locations are fairly convenient for their respective town centres and mainline stations to & from London. As such, the flats were and remain very popular with both tenants & landlords alike.

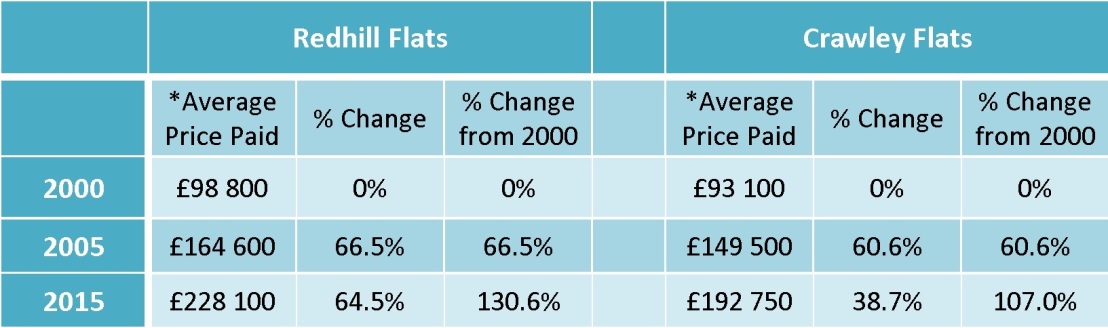

In order to compare the two locations we have used price paid information from HM Land Registry. Historic rental prices, as advertised on Rightmove & Zoopla, were used to calculate rental yields. In Table 1 we show the average prices and capital growth percentages for the flats in Redhill & Crawley over the last 15 years.

Table1: Average prices & capital growth

* Calculated from Land Registry price paid data

Prices in 2000 were roughly the same for both locations, give or take just under £6k. However, average prices for the Redhill flats have increased by 130% over the last 15 years, giving a year on year average compound rate of increase of around 5.74%. This can be compared with Crawley where there has been a corresponding overall increase of 107%, or an average compound rate of increase of 4.97%, year on year. In monetary terms the average Redhill flats have increased by about £129300 over the last 15 years, whereas an average Crawley flat has “only” managed an increase of £99650 i.e. a difference of nearly £30k !

However, as we’ve previously mentioned before in these blog articles, there are two sides to every story and property investment is no exception. For property investment, the flip side to capital growth is rental yield i.e. how many pounds we get back in rent for each pound we invest. Areas with higher rental yields tend to come with lower capital growth and vice-versa. However, combine both and you get a much fuller picture of how well a particular investment is performing.

The investment strategy of the landlord who prompted this article is fairly well balanced between capital growth on the one hand & rental income on the other. In a perfect world he’s happy to sacrifice some capital growth for rental income, so that his investments cover running costs and provide some additional income on top. His running costs include a float for the inevitable breakdowns & repairs, as well as money for refurbishing his properties every 4 to 6 years to keep them fresh & up to date.

So on the face of it, investing in the Redhill flats is a better option in terms of Capital Growth than Crawley. However, what about Rental Yield ?

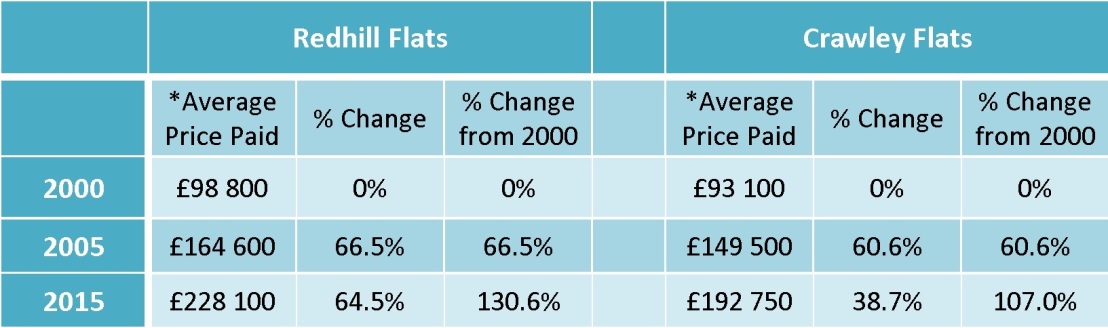

In Table 2 we show average gross rental yields over the last 10 years for the Crawley & Redhill flats in question.

Table 2: Average Gross Rental Yields

The figures in Table 2 show that on average the Redhill flats have a lower average gross rental yield compared with those in Crawley. Over the last 10 years, the difference in yields, shown in the middle column, vary from 9.8% to 16.0%. Another way to interpret this difference is that for every pound you invested in the Crawley flats, you get between 9.8% & 16% more back in rent.

So although the Redhill flats outperform Crawley in terms of Capital Growth, Crawley is clearly the winner when it comes to Rental Yield. Deciding on whether Crawley or Redhill are “best” for you will depend on your investment strategy….. is it driven by income or long term capital growth ?

As far as our landlord is concerned, he’s gone away to think over his investment strategy. His considerations are now whether to change the balance of his portfolio to give higher rental income (i.e. higher yield), sacrifice some of the income for longer term capital growth or stay as he is. We’ll keep you posted on what he decides to do !

If you’re thinking of investing in property in Crawley or surrounding towns, it’s well worth speaking to a property professional who can help point you in the right direction. What & where to buy will depend on your investment strategy, which may be balanced or more skewed towards either capital growth or rental income. We’re more than happy to provide you with free independent advice on any investment purchase you might be contemplating. Just pick up the phone and give us a call on 01293 515588. Alternatively, you can also drop us an e-mail to crawley@northwooduk.com. We look forward to hearing from you.

The opinions expressed in this article are those of the author only and not of

Northwood. If you are considering investing in property you should seek

appropriate professional advice.