5%+ Rental Yield After Adding the Stamp Duty Surcharge ?

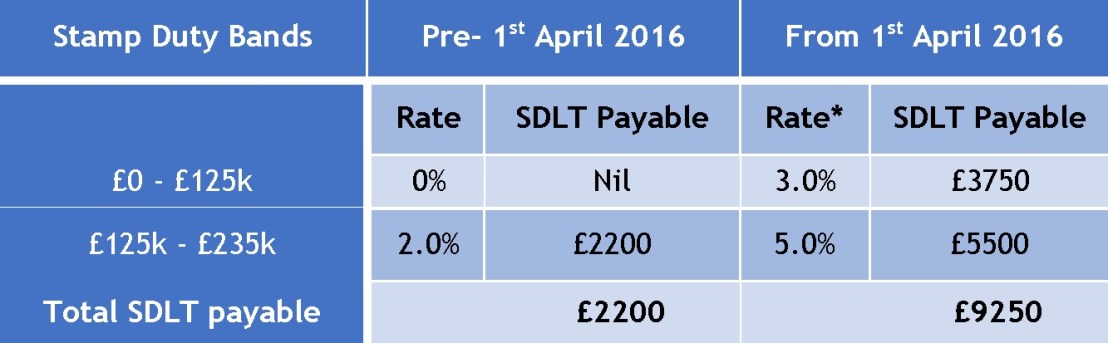

With the additional 3% Stamp Duty surcharge for second property purchases now set in stone, a number of property investors have been concerned about the effect on rental yields.

As we’ve argued previously, however, the Stamp Duty hike imposed by the Chancellor on the 1st April, has to be considered in the grand scheme of an overall property investment strategy – see https://wordpress.com/post/thecrawleypropertyblog.com/2740. Most of the landlords that we know aim to keep their properties for the long term i.e. 10 years plus. This length of time is usually sufficient to “ride-out” the inevitable peaks and troughs associated with property prices. As one wag pointed out to me recently, however, it’s not the peaks that concern him……it’s more the troughs ! Point taken !

So, has the recent Stamp Duty surcharge torn the heart out of buy-to-let ?

From our perspective the answer to this question is currently no. Investment property is for the long haul, not just for Christmas – first mention of the C-word this year ! The 3% additional upfront purchase cost for buy-to-let investors is therefore more of an irritant than a game changer. Of course there are other tax changes that the Chancellor intends to phase in over the next few years, so advice from a qualified tax specialist is probably in order.

However, by way of an example, let’s take a look at a 2 bedroom flat in Southgate West, Crawley, that has just been advertised on Rightmove by estate agents Taylor Robinson. The asking price range is £210000 to £220000. Although the apartment block appears somewhat dated, from the internal photos the property looks to have been refurbished & maintained to a very high standard indeed. Here’s the Rightmove link for a closer look http://www.rightmove.co.uk/property-for-sale/property-53773372.html

Although the asking price for this flat is somewhat higher than similar properties that have sold recently, both the internal condition and seasonal effects of Spring on house prices have probably persuaded the vendors to try for as much as they can get – and why not !

Notwithstanding the higher price, 2 bedroom flats like the one we’re considering here rent for around £925 to £950 pcm. If, as a property investor you decided to add the additional Stamp Duty surcharge onto the purchase price to calculate your rental yield, you would get an effective asking price range from £216300 to £226600. Based on the rental values we’ve quoted, your gross rental yields would now effectively be around 4.9% to 5.3%. These yields are still slightly higher than the UK average at around 4.8%, as quoted for February 2016 by the Your Move and Reeds Rains Buy-to-Let Index – http://www.lslps.co.uk/news/house-price-index. Of course, if you can offset the Stamp Duty surcharge against any Capital Gain when you eventually sell, so much the better !

So there you go – it’s still possible to achieve 5% gross rental yields on Crawley investment properties, even if you add the Stamp Duty surcharge on to the asking price !

If you’re considering investing in property in or around the Crawley area and would like some advice on what & where to buy, please give us a call on 01293 515588. Our advice is free and we’d love to chat “property” with you ! Alternatively, you can also e-mail us on crawley@northwooduk.com.

The opinions expressed in this article are those of the author only and not of Northwood. If you are considering investing in property, please make sure that you seek appropriate professional advice.