Seasonal Uplift in Crawley Property Prices

The daffodils are well & truly out in Crawley and, at the time of writing, we’re still only three quarters of the way through February !

As the weather warms-up & we move towards the Spring, buyers also begin to emerge from Winter hibernation. As a consequence, we start to see the annual pick-up in the housing market up and down the country.

Reflecting this increased activity in the housing market, the February 2016 Rightmove House Price Index (see http://www.rightmove.co.uk/news/February-2016-Property-Trends-Infographic) indicated an average month-on-month increase in asking prices of 2.3%. If this rise were repeated throughout the year, it would mean an annual increase of over 31% !

Well, I can hear you say, “that’s not going to happen, is it !” Our answer to that is …. you’re right, it’s not going to happen !

Nonetheless, however, the 2.3% month-on-month rise reported by Rightmove is indicative of the seasonal factors that provide a boost to asking prices everywhere, including Crawley.

As a number of our landlord investors know, seasonal factors are not the only effect behind the increase in property prices this year. One other important (and hopefully never to be repeated) factor, is the UK Governments proposal to increase stamp duty by 3% for those purchasing 2nd homes, including Buy-to-Let investors.

The Government has argued that Buy-to Let investors have been instrumental in pushing-up property prices, way beyond the reach of first time buyers. To contradict this, however, data released by the Council for Mortgage Lenders (CML), and reported in Landlord Today, (https://www.landlordtoday.co.uk/breaking-news/2016/2/first-time-buyers-outnumber-landlords-three-to-one) shows that although Buy-to-Let investors formed a large proportion of borrowers in 2015, they were in fact out numbered 3 to 1 by first time buyers.

Whatever the merits or otherwise of the Governments proposed stamp duty increase, D-day for the rate hike is set for 1st April 2016. So, if you’re currently in the process of purchasing a Buy-to–Let property, make sure it completes before April fools day, or you might be landed with more than just a silly prank for your efforts !

Some commentators have predicted that after 1st April 2016, demand from Buy-to-Let investors will start to dry up. As someone who does not own a crystal ball, I cannot guarantee this is going to happen – only that the argument seems plausible.

So what about the effect on Crawley property prices ?

It’s clearly too soon to see whether there will be a spike in actual prices paid up to April 2016. This information will probably not be available from Land Registry until sometime in the middle of May. However, a good indication of whether prices are starting to increase is to look at advertised asking prices. This is because an increase in asking prices usually translates into an increase in actual prices paid.

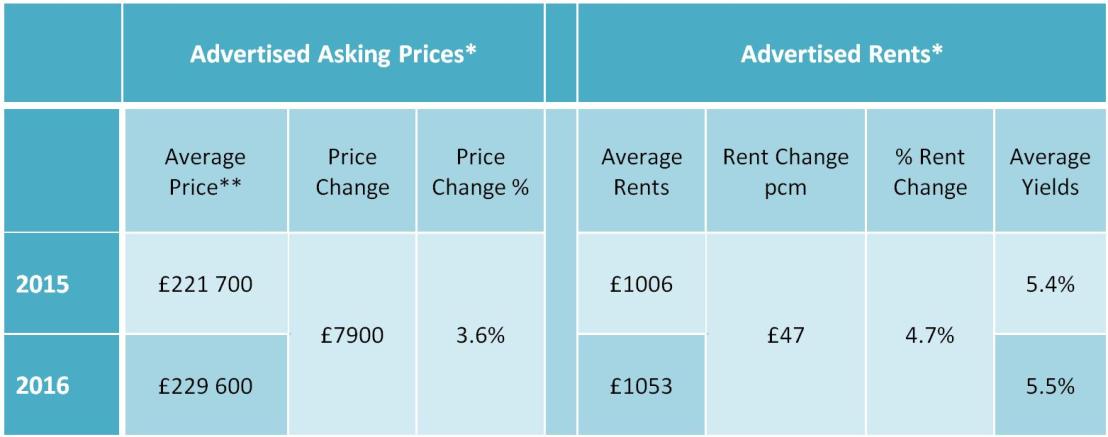

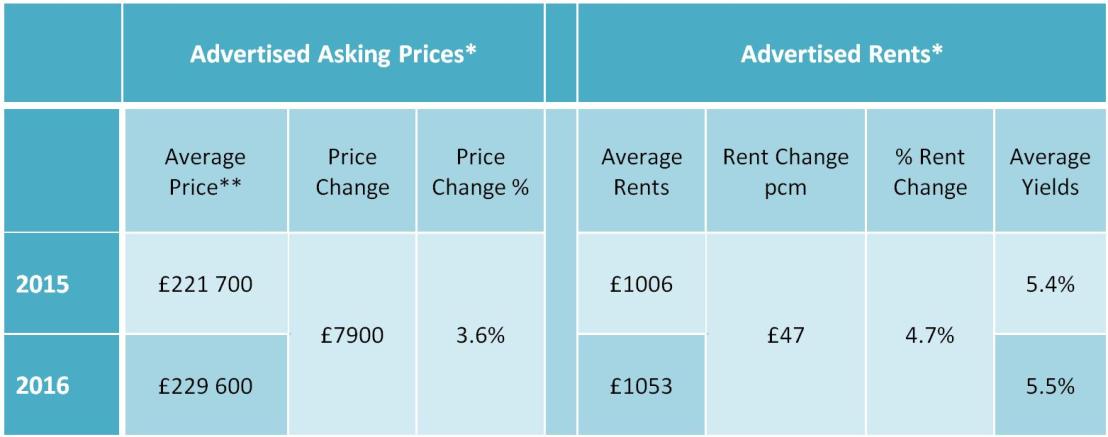

To get a feel for the seasonal effect on property prices, together with any rise associated with the imminent stamp duty increase, we’ve looked at asking prices for 2 bedroom flats at Crawley’s ever popular Commonwealth Drive development. Average advertised asking prices in the last 4 months of 2015 have been compared with those that have come on to the market since the start of 2016. The results are shown in the table below.

Table: Average advertised sales & rental prices for 2 bedroom flats at Commonwealth Drive, Crawley * From Rightmove advertised prices ** Rounded to the nearest £100

* From Rightmove advertised prices ** Rounded to the nearest £100

The table shows that the increase in average asking prices in 2015 compared with 2016 is £7900, or nearly 3.6%. So the price rise for the Commonwealth Drive flats in Crawley has been even higher than the 2.3% rise reported nationally by Rightmove.

As a property investor, one question to ask will be, if the increase in asking prices translates into actual prices paid, how will this affect rental yield ?

In order to give an answer to this question, we checked the average advertised rents over the same periods. We’ve then simply calculated the resulting yield based on advertised asking prices. The results are also shown in the table. As you can see, average rents, which have increased from £1006pcm to £1053pcm, have risen by 4.7% i.e. over 1% more than the advertised asking prices for the same period. The resulting gross rental yields (the right most column in the table) have also improved, albeit, slightly.

In conclusion, although we’re seeing the usual seasonal increase in property prices in Crawley (at least as far as the flats at Commonwealth Drive are concerned), there is also the possibility of an additional effect due to the imminent stamp duty hike for Buy-to-Let investors. Advertised rents have also increased at a higher rate, with rental yields nudging up a little as well.

Please do bear in mind that we can’t judge trends in the whole Crawley property market based on one set of data. Nonetheless it will be interesting to see just what effect the increased stamp duty hike will have on asking prices for flats at Commonwealth Drive and elsewhere in Crawley.

Post April 2016 of course, we’ll also be looking to see whether there are any signs of reduced demand for investment properties from Buy-to-Let landlords. Rest assured, we’ll be on the case just as soon as the information becomes available !

The opinions expressed in this article are those of the author only and not of Northwood. If you are considering investing in property, please make sure that you seek appropriate professional advice.

* From Rightmove advertised prices ** Rounded to the nearest £100

* From Rightmove advertised prices ** Rounded to the nearest £100